Goooooooooood morning TBR! The shower is cold, the coffee is black, the diet is meaty and the money is orange (and pumping!)

So, how are we all feeling? I’ll tell you that I don’t feel much at all. There’s a little bit of excitement, a little bit of joy, but nothing euphoric.

Bitcoin crossed $120k last night. I’ve been checking the spot trading view on Coinbase every now and then and we can see where short position have been liquidated. It makes for some fun green candles. Like this one at $113,750, which pumped us over $116k late last week:

And this one at $120,000 on the nose that pumped us up to nearly $122k:

Notice the volume spikes at the time of liquidation. That’s typical of short sellers getting rekt and not what you see from smart money buying large amounts of Bitcoin. Large purchases are normally dollar cost averaged in a way to keep the price from running on the purchaser, and then announced when the purchases are all complete.

It’s been a fun few days, but let’s take stock of where we are.

Is retail asleep and, as importantly, will it wake up?

Each bull market cycle in Bitcoin’s brief history has been marked by a FOMO bubble driven by retail investors piling on near the end. So far this cycle, retail is dead asleep.

At least it appears so. Google search trends for Bitcoin, which in the past have lined up nicely with euphoric runs, remain near all time lows. That could be because people don’t use Google as much anymore and are turning to AI. I asked AI this very question and the response was that Google search is still the king, and by far. So this is still a decent indicator for this cycle.

Retail is still asleep, but will it wake up? I don’t have a crystal ball, but here’s what I know. Without retail, it’s highly unlikely we get a FOMO bubble, and that could be a very good thing! Without a bubble, the 80% type draw-downs that we have seen in the past won’t happen either. Instead, Bitcoin could grind up for years until retail is ready to come in again.

Keep in mind that the four year cycle history of Bitcoin, where number goes up for three years and crashes to a new but higher floor in the fourth year, is based on a very small sample size. If it holds, we should see more fireworks before this cycle is over, while 2026 would end up being a rough year.

There’s no point in worrying about shots that haven’t been taken yet. As for me, I’m going to continue stacking and wait and see what happens with retail. If there’s evidence that we are entering a manic bubble phase, hopefully we can see it before it’s too late and crashes.

Final note. Don’t root for $1M bitcoin this cycle and don’t root for hyperbitcoinization. If there is one thing about Bitcoin for which I feel pretty certain, it’s that massive price disruption on that level comes from the collapse of the people’s currency. See: Argentina. And that won’t make Bitcoiners any wealthier. 1 BTC = 1 BTC, so the price of goods and services won’t change much for you. Yes, if you own Bitcoin you will be saved from the direct chaos caused by currency collapse. But you won’t be saved from the indirect trauma and that won’t be fun for any of us. My hope is that the dollar survives for a long, long time. If it doesn’t, so be it, but I’m not going to root for my neighbors and friends that haven’t adopted Bitcoin to be completely wiped out. Granted it would be a great thing in the long run for the dollar to collapse, but the short run chaos would be horrible. A gradual replacement would be optimal. Let’s hope for that, no matter how unlikely it is.

I want to thank me

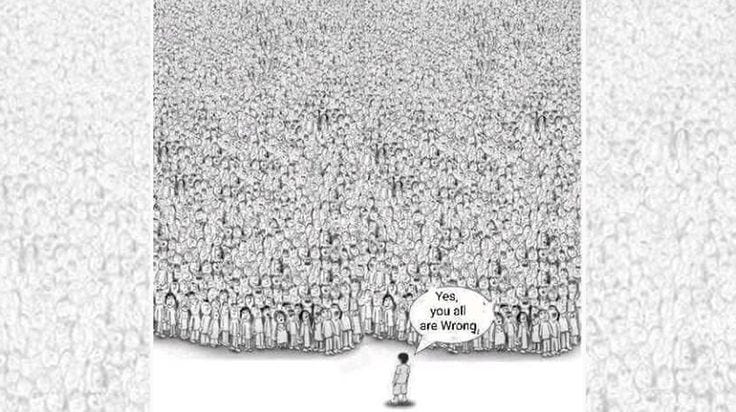

But, enjoy this moment. You were right. Everyone else was wrong. This was you, and to a great extent it still is you, and will be you for many more years:

Personally, I take only a little pleasure in this. It’s nice, and it sure as heck beats losing, but winning this game isn’t as important to me as thinking about how to secure the future of my children, and how to pass the Bitcoin I have along to them, not only so they can use it but so that they know why it’s so important. That’s a much bigger challenge than stacking the coin and watching the price go up and down.

Have a great day and don’t forget to smile and think about your good fortune.

TBR

Thank you for always coming through with a measured, rational, fact-based take on whatever's happening in BTC!